Do you need help recovering an outstanding debt?

Get the cash flowing in your business – contact our debt collection expert, Nathan Tetzlaff today to set up an appointment.

email Nathan

+64 9 8376844

12 July, 2017 | Nathan Tetzlaff

You should send a letter of demand when you have already made various unsuccessful attempts to get a debtor to pay – such as reminder letters and follow up phone calls. A letter of demand is often perceived by the debtor as being more forceful than a reminder letter, but still allows you maintain an ongoing working relationship with your debtor.

It is often used as the initial step in considering whether it is necessary to file legal proceedings for the recovery of a debt.

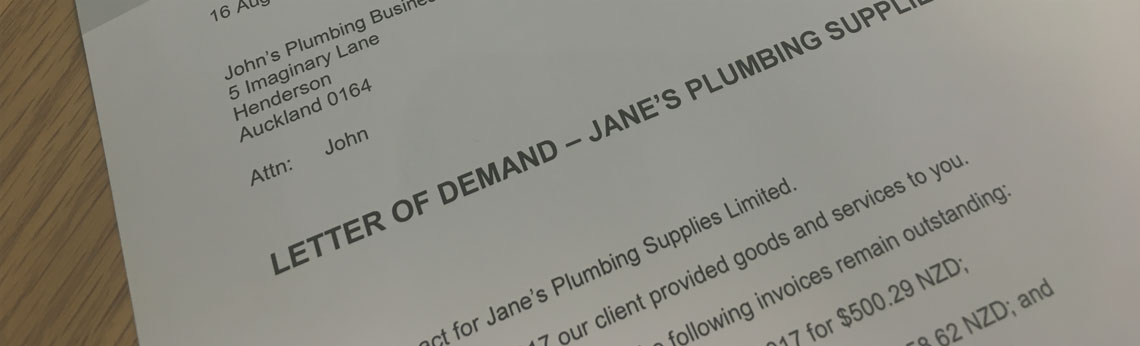

The letter should outline the agreement between the parties, including the amount owed and requesting payment within a definite period of time, usually seven (7) days from the date of the letter.

It is a good idea to include the words “Letter of Demand” in the title of the letter, you may also wish to mention in the letter that you may commence legal action if the debtor does not pay. Technically, a demand can be sent by email but it is recommended that a letter be sent on official letterhead to formalise the demand.

What is the difference between a letter of demand and a statutory demand?

A statutory demand is a document that serves as the first step in the legal process to “wind up” a company (put the company into liquidation). It can be served on companies, and only if certain criteria are met. Serving a statutory demand on a debtor company can result in a breakdown of the ongoing working relationship between you and the debtor.

You can send a letter of demand yourself – on your own behalf or on behalf of your business. However, having a law firm send a letter of demand on your behalf can often provide the extra motivation needed to get a debtor to pay immediately.

A letter of demand:

A letter of demand is a cost effective way of opening up the communication between the parties.